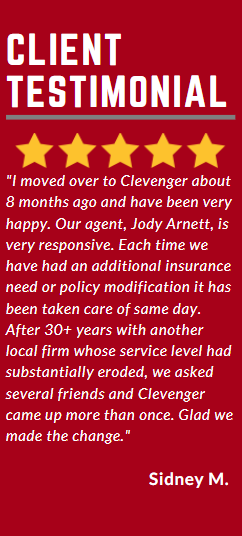

You stand in the middle of your lawn to take in the view and smile proudly as the sun glistens off that shiny, brand-new roof! It took you months to save up just enough money to finally get it replaced, and you feel as though a weight has been lifted from your shoulders. You walk back into the house to go about your day, but what you may not know is that you’re forgetting to do one thing…

Tell your insurance agent!

Yep, that’s right! Your insurance agent will want to know about that new roof for a couple of reasons:

- They’ll need to update the value of your roof, which impacts the overall value of your home. Remember: the insurance company always insures your property based on replacement costs!

- You might just receive a discount on your homeowner’s premium! There are some insurance carriers that offer a discount for a newly updated roof.

So, if you’ve updated your roof or you’re thinking about updating your roof, make sure you save the documentation so you can show it to your insurance agent!

If you have any questions regarding your updated roof, or would like to schedule an insurance review, give Clevenger Insurance a call today at 574-267-2181!