Under your auto policy, you do have the option to purchase what’s called medical pay coverage. This is separate from liability coverage and typically starts around $5k. However, we recommend that you increase your medpay coverage to at least $10k because it provides coverage to you and any passengers in your vehicle who sustain any injuries as a result of an accident.

Medpay is a wonderful coverage offered to you through your auto policy that fills in any gaps in your health insurance coverage. If you have a high deductible health insurance plan and sustain injuries from an auto accident, your medpay coverage would kick in and help you pay that deductible.

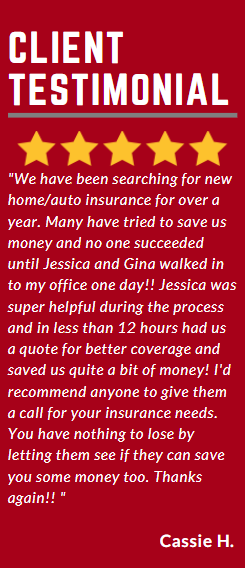

Our goal at Clevenger Insurance is to make sure that you are always covered adequately. So, give our offices a call today at 574-267-2181 if you’d like to bump up your medpay limits or review your insurance policies!